We Do Books™ Blog

Michael DiSabatino of We Do Books™ shares expert insights to help you unlock your business's full potential by delivering proven strategies for maximizing tax savings, streamlining operations, and driving sustainable growth.

The information provided on this site is for general informational purposes only and should not be construed as professional financial, tax, or legal advice. For advice tailored to your specific situation, we recommend consulting with a qualified professional.

The information provided on this site is for general informational purposes only and should not be construed as professional financial, tax, or legal advice. For advice tailored to your specific situation, we recommend consulting with a qualified professional.

1 minute reading time

(201 words)

2026 Mileage Rates Are Here!

New Mileage Rates Announced by the IRS

Big news for 2026: Updated mileage rates are here! The way you record your travel could earn you extra cash in your pocket.

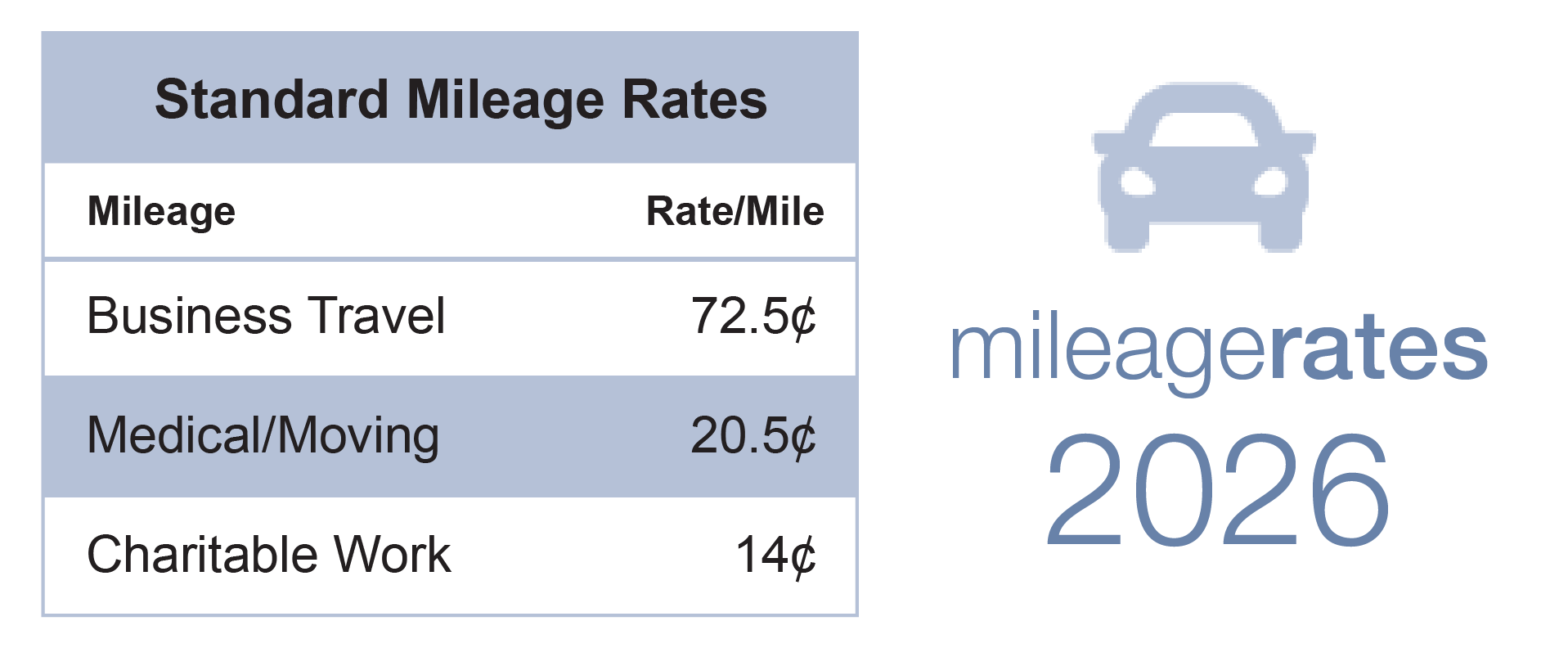

- The standard business mileage rate increases by 2.5 cents to 72.5 cents per mile.

- The medical and moving mileage rates go down 1/2 cent to 20.5 cents per mile.

- Charitable mileage rates remain unchanged at 14 cents per mile.

2026 New Mileage Rates

Here are the 2025 mileage rates for your reference.

Please note:

- These rates apply to gas, electric, hybrid-electric, and diesel-powered vehicles.

- You cannot claim mileage as an itemized deduction as an employee if you aren't reimbursed for travel expenses.

- Claiming a mileage deduction for moving expenses is not allowed unless you are an active member of the Armed Forces and are ordered to move to a new permanent duty station.

Remember to properly document your mileage to receive full credit for your miles driven.

This publication provides summary information regarding the subject matter at time of publishing. Please call with any questions on how this information may impact your situation. This material may not be published, rewritten or redistributed without permission, except as noted here. All rights reserved.

How do you feel about this post?

Stay Informed

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.